PhD Student

Romain Presty joined the Economics department of IFP School on the 28th of November 2022 to conduct his PhD work on Equilibrium Modelling of Carbon Dioxide Removal (CDR) Markets in partnership with CentraleSupélec.

During his master’s degree on Environmental and Energy Economics at Toulouse School of Economics, he worked as a teaching assistant for second year students. After graduated, he worked on the project EcoReBa alongside Anna Creti of the Climate Economics Chair.

On his arrival at IFP School, Romain participated in the class offered by Steven A. Gabriel on Equilibrium Programming in Engineering. This experience helps him to combine economics and engineering approach for his thesis.

He is entitled to add his economics view of markets to an engineering literature on Carbon Dioxide Removal (CDR). Understanding people’s behavior is important to him and believe it is necessary to regulate the CDR market.

Market Equilibrium Modeling for Carbon Dioxide Removal Markets

Id. card:

PhD position at IFP School

Supervision: The thesis will be jointly directed by Prof. O. Massol and Prof. P. Da Costa.

- Pascal DA COSTA

Education: PhD. in Economics (Université Paris 1 Panthéon-Sorbonne) ; HDR

Employment: Professor in Economics (CentraleSupelec), Executive Director of the Chair Capitaldon “Sustainable Growth”

Prof. Da Costa's expertise is in environmental economics.

- Olivier MASSOL

Education: HDR (Habilitation) in Economics (U. Paris-Dauphine)

PhD. in Economics (City, Univ. of London)

Ingénieur Civil des Mines (St Etienne)

Employment: Professor in Economics (IFP School)

Head of the Energy Transitions Program, Climate Economics Chair

Researcher, Industrial Engineering Lab. CentraleSupelec (U. Paris-Saclay)

Honorary Research Fellow (City, Univ. of London)

Prof. Massol's expertise is in both energy economics and the modelling of network industries.

Contact: Prof. Olivier MASSOL @: olivier.massol@ifpen.fr

Host: IFP School, Rueil-Malmaison, France

Key words: Carbon Dioxide Removal (CDR), Negative Emissions Technologies (NETs), BioEnergy, CCS, Sustainable Development Goals, Carbon Markets, Economics modeling

Profile: Engineering School + specialization in energy and environmental economics,

Experience with operations research models used in the energy sector

Beginning of the research work: fall 2022

Research topic

The Paris Agreement has set ambitious targets to limit global warming to "well below" 2°C by 2100, and to pursue measures to contain it to 1.5°C. These objectives can hardly be attained absent a sizeable deployment of Carbon Dioxide Removal (CDR) methods, such as Afforestation/Reforestation (AR), Bioenergy with Carbon Capture and Storage (BECCS), and Direct Air Carbon Capture and Storage (DACCS) (IPCC, 2022). Integrated Assessment Model scenarios estimate that 190 to 1,190 GtCO2 of cumulative removal will be needed by 2100 (Huppmann et al., 2018; Rogelj et al., 2018). The magnitude of these deployment needs raises numerous economic and policy concerns pertaining to: the important cost of that deployment, the fierce competition for resources it may create (e.g., to acquire bioenergy resources), the societal demand for social justice, and possible threats on biodiversity, and (Fuss et al., 2018; Heck et al., 2018; Smith et al., 2016).

The purpose of this doctoral project is to broaden the understanding of the conditions for a massive deployment of these technologies. More specifically, our ambition is to examine the economics of CDR technologies in a market environment. At present, while there are active carbon allowance markets in both the U.S. and Europe (e.g. RGGI, 2022; EU ETS, 2022), there are no CDR markets functioning. Yet, these markets are expected to play a key role to trigger investment in CDR technologies and their creation is recurrently discussed in climate policy debates.

Our analysis will be structured as a collection of three projects that will be treated sequentially. They together provide the architecture of the proposed doctoral project.

- Part 1 – the deployment of CDR technologies, an equilibrium approach

This first part will concentrate on the economics of the CDR markets that are currently envisioned to govern the provision of CDR capabilities. Our ambition is to examine the economics of a large and market-driven deployment of CDR technologies using a spatial and dynamic equilibrium model. That model will be specifically designed to investigate the following research questions:

• What CDR technologies will be deployed? Where will that deployment occur and with what magnitude?

• Will that deployment necessitate the implementation of international supply chains? If yes, what will be the magnitude of the associated gains to trade?

• How will that deployment affect price formation at carbon markets and at markets for CDR?

To the best of our knowledge, the two first questions have so far been explored using standard optimization techniques (i.e., linear programming in Fajardy et al., 2018). While these models have merits (e.g., to provide a very detailed, and engineering-sound, representation of the associated supply chains), they are cursed by at least three limitations. First, they can hardly represent the strategic interactions among countries. For doing a game theoretic framework à la Nash would be preferable. Second, by nature, they can hardly provide an informative representation of the economic interactions among the participating agents. Lastly existing models have so far overlooked the implications on the price formed at carbon markets and at the markets for CDR that are currently discussed in climate agreement. Hence, these models can hardly be used to contribute to the ongoing discussions on the economics of Article 6 of the Paris Agreement.

To remedy this, we propose an alternative approach that consists in examining these questions using an equilibrium model. By nature, equilibrium models are capable to represent the interactions among economic agents and the effects of their individual actions on the market prices. They can also incorporate game theoretic aspects. For the sake of computational tractability, the resulting enriched representation of the economics of that supply chain can necessitate a simpler representation of the engineering details. That model will be formulated as an instance of a mixed complementarity problem à la Gabriel et al. (2013) or Abada et al, (2013).

- Part 2 – The formation of stable CDR coalitions

The second part aims at examining whether a market-based deployment of CDR can yield the formation of stable international coalitions. This is a crucial point to make the market-based approach successful.

²The point of departure of our analysis will consist in combining the outcomes of the preceding model with an adapted cooperative game-theoretic framework.

In the literature, some preliminary analyses based on cooperative game theory have already been proposed to study how the coalitional cost-savings prompted by international cooperation in CDR deployment (e.g., Chiquier et al., 2022). These studies rely on the theory of cooperative games with Transitive Utility and typically use as an input to the solutions of large linear programming problem aimed at computing the least-cost deployment of CDR in a given set of regions. Despite their merits, this approach is not satisfactory because – as discussed above – these models can hardly capture the economics of the price formed at CDR markets.

In the present analysis, our ambition is to overcome that limitation by considering a somewhat more general form for the representation of cooperative games: the partition function form. That form has been known since the 1960s but has only begun to attract interest in the 1990s. Here, our point of departure is in the application of this class of games to the treatment of externalities and the identification of stable coalitions that has been prompted by Carlo Carraro and his colleagues at the FEEM (Fondazionne Enrico Mattei). Our ambition is to apply these concepts to the model developed in Part 1.

A series of insightful findings are expected from that analysis regarding: (i) the stability of the climate coalitions necessary for a cost-effective CDR deployment, (ii) the sharing of the associated costs and gains among nations. Such an analysis will provide useful guidance for the institutional design of CDR markets.

- Part 3 – Market design issues: setting up an incentive playground for firms and coun-tries

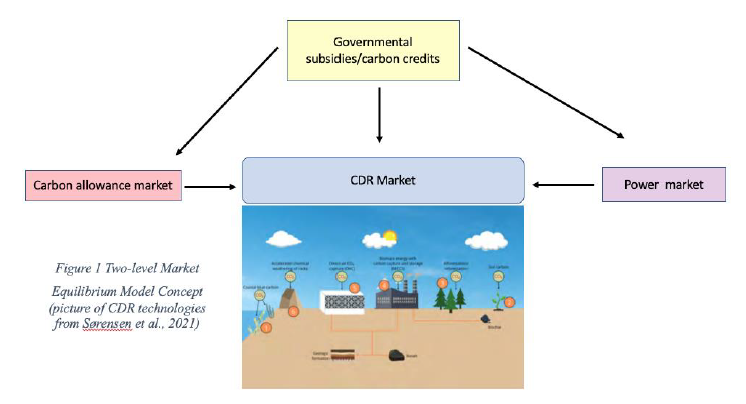

Lastly, the final part of the thesis will adopt a public policy standpoint and concentrate on the policy instruments that can be developed to foster the deployment of CDR. More specifically, our intention is to include the governmental/policymaking scene into the model by proposing an extended two-level approach like the one recently proposed in Sørensen et al. (2021). The purpose of building such a market equilibrium model and doing policy-related sensitivity analysis with it once finished, is to understand the best way to incentivize formation and success of CDR markets.

As shown in Figure 1, the proposed market equilibrium model will be two-level, otherwise known as a mathematical program with equilibrium constraints (MPEC) (Gabriel et al., 2013). At the top level is the government that decides on the level of subsidies/feed-in tariffs for low-carbon or no-carbon technologies or CDR technologies to maximize some measure of social benefit (e.g., social welfare). They can also consider some sort of carbon credit if pertinent. Below the top level are three markets to concentrate on: the carbon allowance market (e.g., EU ETS, RGGI), a new CDR market, and the power generation market for a particular region. As described by Sørensen et al. (2021), there are six main CDR technologies: 1. Coastal blue carbon, 2. Soil carbon and biochar, 3. Afforestation, 4. Bioenergy with CO2 capture and storage (BECCS), 5. Direct air carbon capture with storage (DACCS), and 6. Mineralization and enhanced weathering. Each one of these technologies has different risks, verification challenges, and costs but some portfolio of them, perhaps different for each region, could be a viable way to meet climate change/decarbonization goals.

The proposed CDR market model will consider multiple players including for example: governments and private energy companies contributing to funding the development of and activity in this CDR market. The funding would come from the companies’ participation in carbon allowance markets (e.g., revenues for producing renewable energy or low-carbon energy), direct governmental subsidies/feed-in tariffs, carbon credits for companies that provide financial offsets to be used for CDR, or direct investment in CDR technologies by the companies. The companies and the government could also just invest their funds in the carbon allowance markets (for improved renewable power technologies) or in power generation (as part of their overall business). Thus, the companies will be modeled as profit-maximizers, trying to decide how to make their investments in these various markets. The government, at the same time will be trying different policy instruments to gauge the feedback from the companies to arrive at a socially optimal decision.

Here, our analysis will concentrate on the identification of time-consistent trajectories for the incentive policies to be decided by the governmental player.

References

Abada, I., S.A. Gabriel, V. Briat, and O. Massol. (2013). A Generalized Nash-Cournot Model for the North-Western European Natural Gas Markets with a Fuel Substitution Demand Function: The GaMMES Model. Networks and Spatial Economics, Vol. 13(1), 1-42.

Chiquier, S., Jagu, E., Mac Dowell, N., Massol, O., 2022. CO2 removal and 1.5°C: Sharing the Gains from Inter-regional Cooperation using a Cooperative Game-Theoretic Approach. Presentation at the 2022 Conference on Negative CO2 Emission. Goteborg, June 2022.

Fajardy, M., Chiquier, S., Mac Dowell, N., 2018. Investigating the BECCS resource nexus. Energy Environ. Sci. 11, 3408–3430.

Fuss, S., Lamb, W.F., Callaghan, M.W., Hilaire, J., Creutzig, F., Amann, T., Beringer, T., Oliveira Garcia, W., Hartmann, J., Khanna, T., Luderer, G., Nemet, G.F., Rogelj, J., Smith, P., Vicente, J.L.V., Wilcox, J., del Mar Zamora Dominguez, M., Minx, J.C., 2018. Negative emissions—Part 2: Costs, potentials and side effects. Environ. Res. Lett. 13, 63002.

Gabriel, S.A., A.J. Conejo, B.F. Hobbs, D. Fuller, C. Ruiz, Complementarity Modeling In Energy Markets, Springer, 2013, New York.

Heck, V., Gerten, D., Lucht, W., Popp, A., 2018. Biomass-based negative emissions difficult to reconcile with planetary boundaries. Nat. Clim. Chang. 8, 151–155.

Huppmann, D., Rogelj, J., Kriegler, E., Krey, V., Riahi, K., 2018. A new scenario resource for integrated 1.5°C research. Nature Climate Change. 8, 1027–1030.

IPCC, 2022. Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge, UK and New York, NY, USA. https://doi.org/10.1017/9781009157926

Rogelj, J., Popp, A., Calvin, K. V, Luderer, G., Emmerling, J., Gernaat, D., Fujimori, S., Strefler, J., Hasegawa, T., Marangoni, G., 2018a. Scenarios towards limiting global mean temperature increase below 1.5 C. Nat. Clim. Chang. 8, 325–332.

Smith, P., Davis, S.J., Creutzig, F., Fuss, S., Minx, J., Gabrielle, B., Kato, E., Jackson, R.B., Cowie, A., Kriegler, E., van Vuuren, D.P., Rogelj, J., Ciais, P., Milne, J., Canadell, J.G., McCollum, D., Peters, G., Andrew, R., Krey, V., Shrestha, G., Friedlingstein, P., Gasser, T., Grübler, A., Heidug, W.K., Jonas, M., Jones, C.D., Kraxner, F., Littleton, E., Lowe, J., Moreira, J.R., Nakicenovic, N., Obersteiner, M., Patwardhan, A., Rogner, M., Rubin, E., Sharifi, A., Torvanger, A., Yamagata, Y., Edmonds, J., Yongsung, C., 2016. Biophysical and economic limits to negative CO2 emissions. Nat. Clim. Chang. 6, 42–50.

PhD work versus State of Art

The economic analysis of CDR technologies is a recent but rapidly growing topic in the literature. Yet, to the best of our knowledge, the proposed doctoral project is one of the very first to provide a comprehensive analysis of the economics of that technology that includes:

- the development of an equilibrium model of the international trade interactions induced by the development of BECCS. That model will use advanced modeling tools (i.e., the specification of a mixed complementarity problem) and will be the very first to combine two important ele-ments: (i) a high-level representation of that complex supply chain that will capture the engi-neering realities, and (ii) the complex interactions between these supply chain and the for-mation of carbon prices.

- an evaluation of the countries’ propension to engage in the deployment of these technologies that will naturally call for an examination of the associated gain-sharing problem using cooper-ative game-theoretic techniques.

- an evaluation of the firm’s propensity to invest in these technologies which, in turn, requires,

- a public policy perspective aimed at designing the optimal support scheme for that technology.

Research work strategy

As a preliminary step in the progression towards a PhD., the student is expected to prepare a condensed (but commented) review of the recent literature on the economics of CDR and CDR markets (indicative duration: 2 months).

The doctoral project will then successively address the following topics:

(i) Provide a synthetic analysis of the main economic interactions that exists among the vari-ous components of (and thus the various participants involved in) the value chain.

(ii) Development of an adapted equilibrium model of these interactions. We envision to speci-fy, calibrate and solve an equilibrium problem which mathematically corresponds to an in-stance of a Mixed Complementarity Problem (MCP). MCPs have extensively been used to examine the economics of a variety of commodity markets (e.g., Abada et al. (2011) for natural gas). That model will then be applied to identify the conditions for the existence of a net positive social surplus derived from the deployment of these CDR technologies.

(iii) Development of an adapted cooperative game theoretic framework capable to check the existence of an incentive compatible sharing of the benefits and costs of the proposed in-ternational value chain among the participating countries. The goal assigned to that de-velopment is to inform policy making and the design of the specific climate agreements needed for the deployment of CDR technologies.

(iv) Building upon the insights gained on the economics of BECCS, the PhD. student will then study the economics of the public policies that can be proposed to support the deployment of BECCS capabilities (e.g., standards, fiscal subsidies, sectoral regulation).

The overall conclusion to the thesis will present the main conclusions and policy implications derived from that doctoral project. In particular, it will present in a non-technical manner how the insights gained from the analyses and development above enrich our understanding of the merits and limitations of the various CDR technologies. It will also discuss the role that should be assigned to each of these technologies in an ambitious but realistic climate scenario.

To address that research program, the proposed project ambitions to build upon three different strands of the literature:

- microeconomics (more specifically environmental economics)

- operations research (more specifically mixed complementarity problem)

- game theory (more specifically cooperative games)

Deliverables

At the end of the thesis, we will have developed:

- an equilibrium model capable to characterize the economic barriers to the deployment of CDR technologies and to investigate the public policies adapted to support the emergence of these technologies.

- an adapted cooperative game theoretic framework (i.e., games in partition function form) that can be combined with the equilibrium model to examine the countries’ propensities to cooper-ate. Such a modeling approach will provide us with an opportunity to examine the bargaining and gain sharing problem associated with the deployment of CDR at the global scale.

- an expertise on the emerging public policy discussions pertaining to CDR and CDR markets.

Three papers (at least) are expected:

- one on the equilibrium model,

- one on the application of cooperative game theoretic notions,

- and a policy paper on the public policy measures that can be implemented to support the emergence of CDR technologies.

These manuscripts will be submitted to dedicated scientific journals. Depending on the nature of the work, they may be submitted to journals dedicated to: energy and environmental economics (e.g. Energy Economics, Energy Policy, Climate Policy), operations research (e.g. European Journal of Operations Research), industrial economics or energy (e.g. Applied Energy).

If possible, the literature review will be published in an appropriate journal (e.g. Current Sustainable/Renewable Energy Reports, Renewable and Sustainable Energy Reviews, Science and Technology for Energy Transition).

Publications:

|

Image

|

Market-Based deployment of Engineered Carbon Dioxide Removal Technologies in Europe Romain Presty IFPEN Economic Papers, N°165, February 2026. Available here. |

|

Image

|

Market Mechanisms for Carbon Dioxide Removals: An Overview Flore Verbist, Emma Jagu Schippers, Injy Johnstone, Coline Seralta, Romain Presty & Antigoni Theocharidou Curr Sustainable Renewable Energy Rep 12, 29 (2025). https://doi.org/10.1007/s40518-025-00277-6 |

|

Image

|

Global Collaboration in Carbon Dioxide Removal: Navigating a Fragmented Landscape Romain Presty, Olivier Massol, and Pascal da Costa Curr Sustainable Renewable Energy Rep 12, 30 (2025). https://doi.org/10.1007/s40518-025-00280-x |

|

Image

|

Mapping the landscape of carbon dioxide removal research: a bibliometric analysis Romain Presty, Olivier Massol, Emma Jagu and Pascal da Costa Environmental Research Letters - Volume 19, September 2024, 103004 - https://doi.org/10.1088/1748-9326/ad71e0 |

Communication in conference:

Poster: "First paper: Dynamics of the Carbon Dioxide Removal Literature: A Bibliometric Analysis"

IEAGHG’s 15th International Interdisciplinary CCS Summer School

July, 2023 in Regina, Canada

IEAGHG’s 15th International Interdisciplinary CCS Summer School

(July, 2023 in Regina, Canada)

Romain Presty joins the CarMa Research Team

November 30, 2022